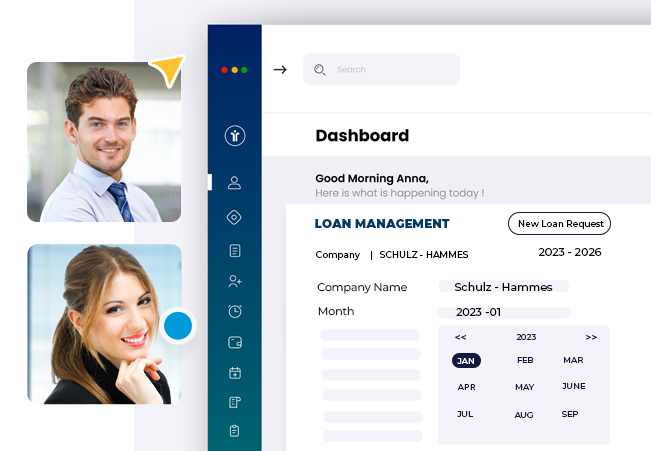

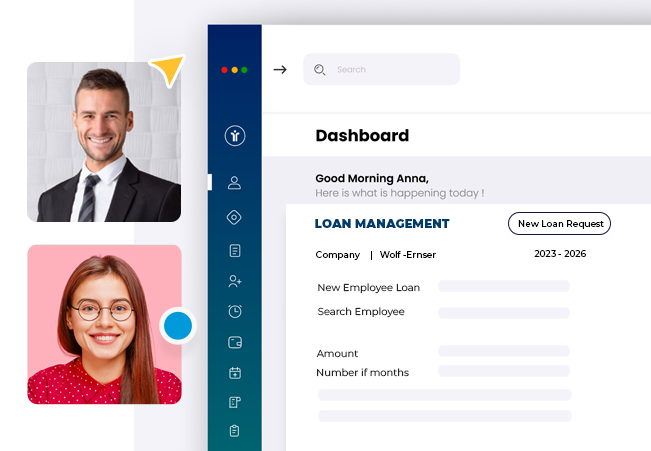

Companies can automate their HR procedures, provide employees with up-to-date information, and make smarter business decisions.

Industries

Our software aids different industries in enhancing the employee experience while boosting productivity and achieving growth.

FAQ

Discover the perks of HR & Payroll software and how to choose the best one for your business.

How to Calculate Full and Final Settlement?

Outstanding wages, if a worker worked throughout that time, they should be compensated for their time worked as well as any unclaimed awards and benefits.

Payment regarding notice, if the employee works within the notice period, you must pay them the full amount.

Annual leave, the employee’s use of personal or ordinary leave is not eligible for encasement. Nevertheless, unused yearly leaves can still be utilized.

Extra payment, in accordance with business policy, this also includes other wage components such as long-term service leaves encasement, legal entitlements, severance pay, etc.

Say Hello