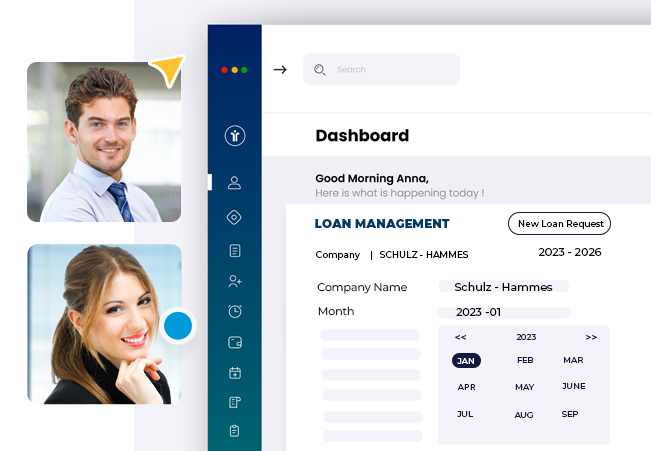

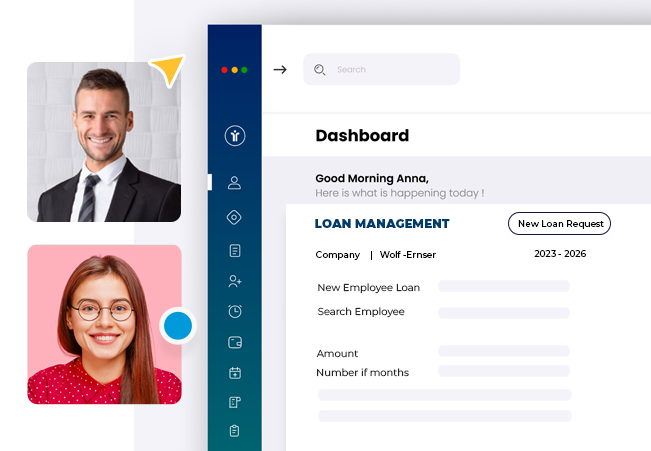

Companies can automate their HR procedures, provide employees with up-to-date information, and make smarter business decisions.

Industries

Our software aids different industries in enhancing the employee experience while boosting productivity and achieving growth.

FAQ

Discover the perks of HR & Payroll software and how to choose the best one for your business.

Payout for Unused Vacation Days:

The payout for accrued vacation days go at a regular pay rate.

Most companies offer different alternatives to provide leave encashment. It can be via direct deposits, checks, cash, or installment payments.

Bank-to-bank transfers are the most common option for large sums.

Installment payments can be ideal if the employee is still working within the company when requesting leave encashment.

The time frame for this payment is usually within a week or 21 days.

Say Hello