Want to master gratuity compliance in the UAE? Start here with our expert 2025 guide.

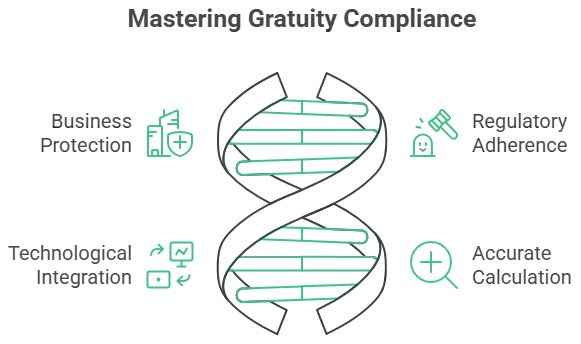

Understanding gratuity benefits in the UAE is more than just paying employees fairly. It’s about protecting your business, reputation, and bottom line. With 2025 bringing stricter labor regulations and heightened government audits, employers can no longer afford guesswork. Using outdated systems puts them behind in the growing market.

This guide breaks down everything you need to know, from eligibility to accurate calculations. Learn how smart HR tech like ConnectHR transform your end-of-service process into a compliant, automated advantage.

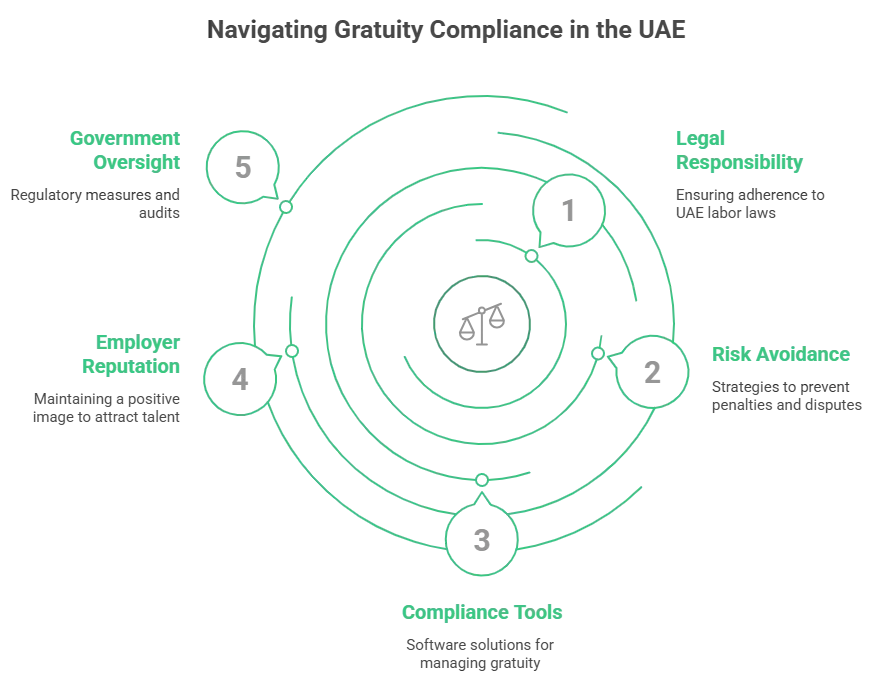

Why Gratuity Compliance Is Critical for UAE Employers in 2025?

Gratuity rules in the UAE have evolved significantly, especially in 2025. It’s no longer just about basic end-of-service dues—it’s about legal responsibility and avoiding risk. UAE businesses must now take gratuity as seriously as any other financial obligation.

Want to avoid fines, lawsuits, or employee turnover? It all starts with understanding gratuity benefits. In today’s UAE business climate, gratuity isn’t just about payouts, it’s a reflection of your compliance, professionalism, and employer reputation.

The UAE government has made labor law compliance a top priority in 2025. This includes regular audits, stricter penalties, and tighter oversight. As a result, every business, whether a startup or a large enterprise, needs to ensure its HR practices. Also, they need to make sure that the gratuity management is accurate and legal.

Non-compliance may lead to severe penalties, such as heavy fines or license suspension. Gratuity-related disputes can also damage your employer brand, making it harder to attract talent. By using automated tools, businesses not only stay compliant but also save time and prevent legal trouble.

It’s no wonder smart employers are investing in tools like ConnectHR to stay ahead, automate processes, and avoid costly errors.

What Exactly Are Gratuity Benefits in the UAE?

Before diving into calculations or tools, it’s essential to understand the foundation. What is gratuity, and why is it a legal must in the UAE?

Gratuity benefits are a lump-sum financial benefit employers must pay when an employee completes their service. It is a legal right outlined under Federal Decree Law No. 33 of 2021, further reinforced by Cabinet Resolution No. 1 of 2022.

This payment serves as a reward for loyalty and helps employees transition financially after leaving a job. The purpose is to ensure financial security for workers who have dedicated time and effort to an organization.

Gratuity is calculated based on an employee’s basic salary and years of service. It becomes mandatory after a minimum of one continuous year of employment. This benefit is due regardless of whether the contract is limited or unlimited, though calculations vary. Employers should also note that gratuity must be paid within 14 days of the contract ending. Failure to do so can result in penalties or labor complaints. This makes timely processing as important as accurate calculation.

Gratuity Calculation in 2025: A Clear, Mistake-Free Formula for Employers

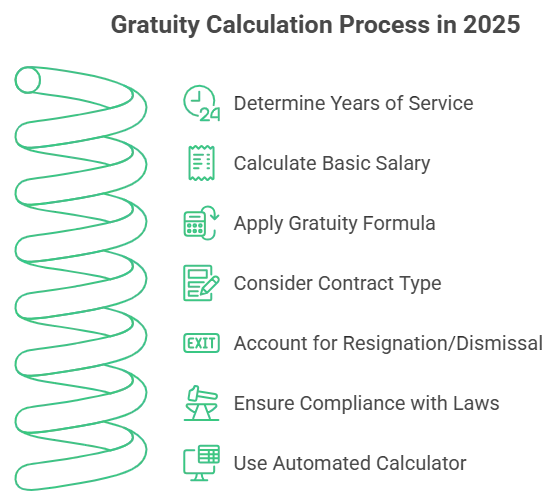

Calculating gratuity might seem simple on paper, but the 2025 laws have introduced added layers. It is especially for companies managing diverse contract types and flexible work setups. Here’s how to do it right.

Basic Formula for Gratuity Computation:

The formula for gratuity depends on years of service and basic salary:

| Years of Service | Gratuity Calculation |

| Up to 5 years | 21 days’ basic salary per year |

| Over 5 years | 30 days’ basic salary per year |

Formula: Gratuity = (Basic Salary ÷ 30) x Eligible days x years of service

Key Changes or Updates in 2025 Regulations

Recent updates to labor law include:

- Option to join gratuity savings schemes as an alternative to traditional payouts.

- Part-time, remote, and flexible workers now qualify for proportional gratuity.

- Employment contracts must clearly state basic salary to avoid confusion.

These changes ensure fair treatment of all workers, including those in non-traditional roles. Employers should adjust policies to reflect the latest laws.

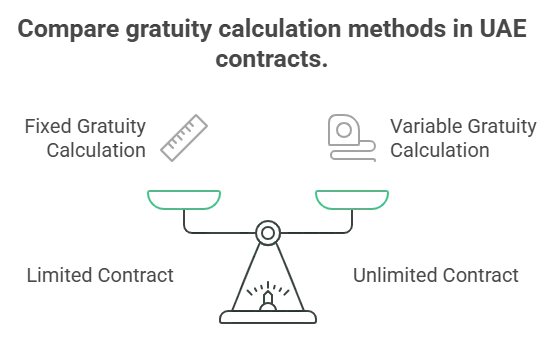

Gratuity Calculation Under Limited vs. Unlimited Contracts

- Limited Contracts: Full gratuity if contract completes as agreed.

- Unlimited Contracts: Calculation varies if employee resigns early, is dismissed for misconduct, or terminates without notice.

Pro Tip: ConnectHR’s automated gratuity calculator ensures error-free end-of-service payouts that comply with current UAE laws.

Gratuity Eligibility Rules: Who Gets Paid and Who Doesn’t?

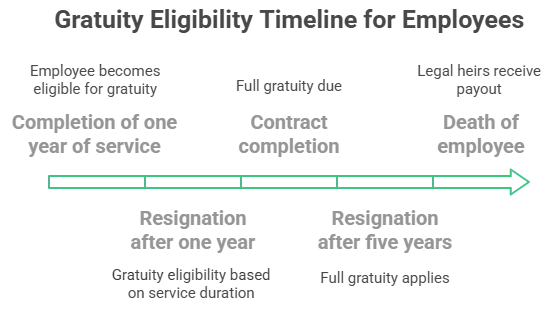

Not every employee qualifies for gratuity benefits. Understanding eligibility requirements helps avoid confusion, disputes, and errors in HR processing.

Minimum Service Requirements:

An employee must complete at least one year of continuous service to qualify for any gratuity. The longer the service, the higher the entitlement. Employees working under probation, or who leave before completing one year, are not eligible. Employers should keep accurate records to track service length.

Termination Conditions Affecting Eligibility:

Eligibility changes based on how the job ends:

- Contract completion: Full gratuity due.

- Resignation after one year: Eligible but based on duration.

- Dismissal for misconduct: No gratuity paid.

Proper documentation is key. Employers should record resignation letters, termination notices, and reason for dismissal.

Exceptions and Special Cases:

Some special conditions include:

- Death of employee: Legal heirs receive the payout.

- Resignation after 5 years: Full gratuity applies.

- During probation: No gratuity is paid during or after probation period.

Employers must review each case individually and apply the law accordingly.

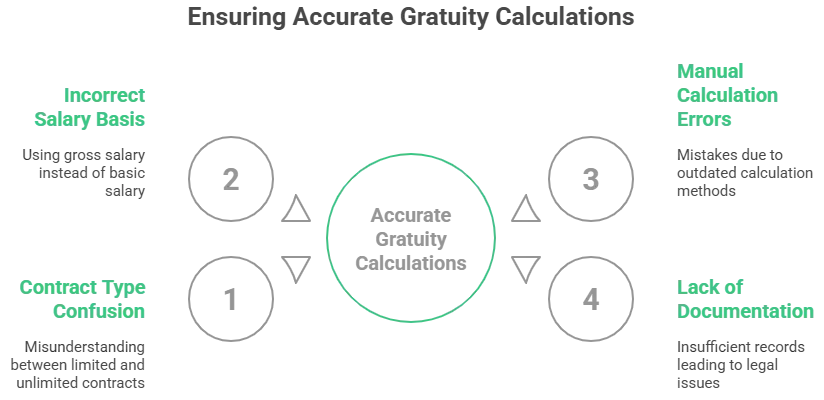

Top Gratuity Mistakes Employers Make (And How to Avoid Them in 2025)

Even well-intentioned employers can make costly gratuity errors. Here are the most common mistakes and how to ensure your company avoids them in 2025.

Misunderstanding Contract Types:

Employers often confuse limited and unlimited contracts, leading to wrong calculations and disputes. Each contract type has unique rules for gratuity payout. Clarify this upfront with employees.

Incorrect Salary Basis for Calculation:

Using gross salary instead of basic salary is a common mistake. Only basic salary should be considered for gratuity. Gross salary includes allowances, which are not part of gratuity calculations. Clarify this in employment contracts.

Manual Calculation Errors and Lack of Documentation:

Using spreadsheets or outdated methods causes mistakes. Failure to keep proper records can lead to legal claims. ConnectHR helps eliminate these errors through real-time HR data integration and compliance tracking.

Automate Gratuity & Stay 100% Compliant with UAE Law Using ConnectHR

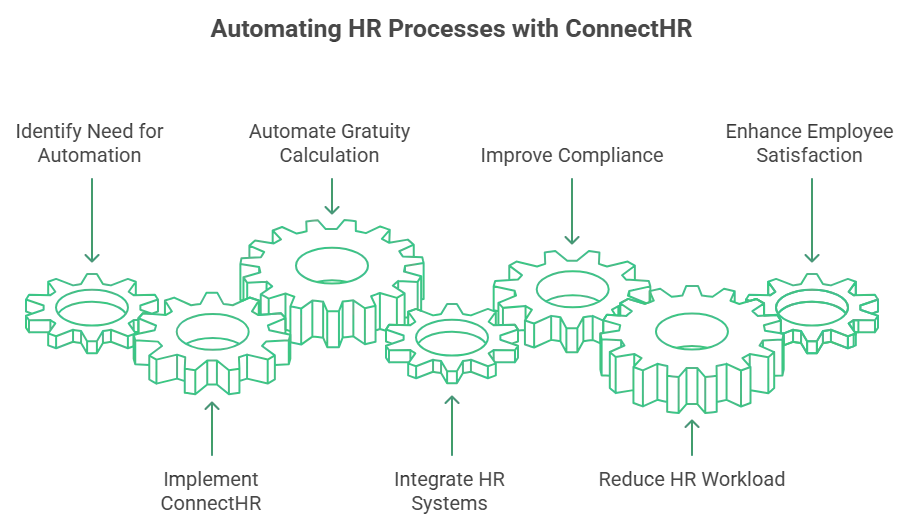

In 2025, relying on manual calculations or outdated software puts your business at risk. Automation is no longer optional; it’s essential.

Automation helps HR teams save time and avoid costly errors. With ConnectHR, gratuity benefits are calculated accurately with every policy update reflected instantly. This reduces risks and ensures every employee is treated fairly under the law.

ConnectHR links payroll, contracts, and leave management. It updates data automatically, so there’s no manual entry or risk of oversight. It creates one central platform for all HR processes, increasing visibility and reducing time spent on admin.

A mid-sized retail firm in Dubai had frequent disputes due to manual gratuity processing. After adopting ConnectHR, their compliance improved, HR workload dropped by 30%, and employee satisfaction grew.

UAE Gratuity Law Penalties in 2025: What Happens If You Get It Wrong?

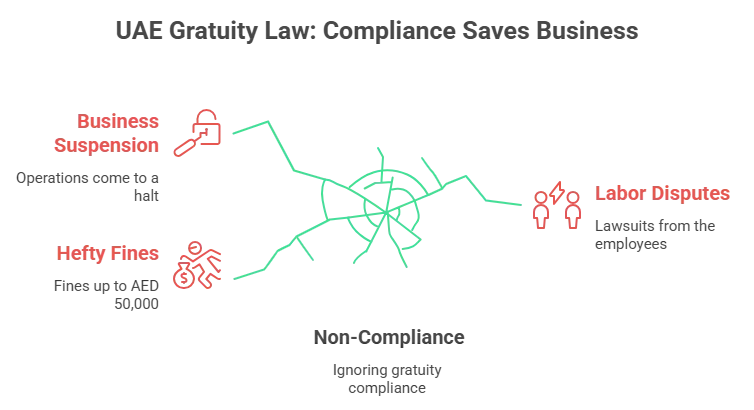

Ignoring gratuity compliance is risky business. In 2025, UAE authorities are doubling down on enforcement with bigger penalties and fewer warnings. Staying updated with labor law ensures your business stays safe from penalties and keeps its reputation clean. Regular training and using the right HR tools ensure your team remains compliant.

Penalties for Non-Compliance

Failing to manage gratuity correctly may lead to:

- Fines up to AED 50,000

- Suspension of business operations

- Labor disputes and lawsuits from employees

ConnectHR’s compliance-first approach ensures your business is audit-ready and aligned with the latest UAE labor guidelines.

Why UAE Employers Are Switching to ConnectHR for Gratuity & Payroll

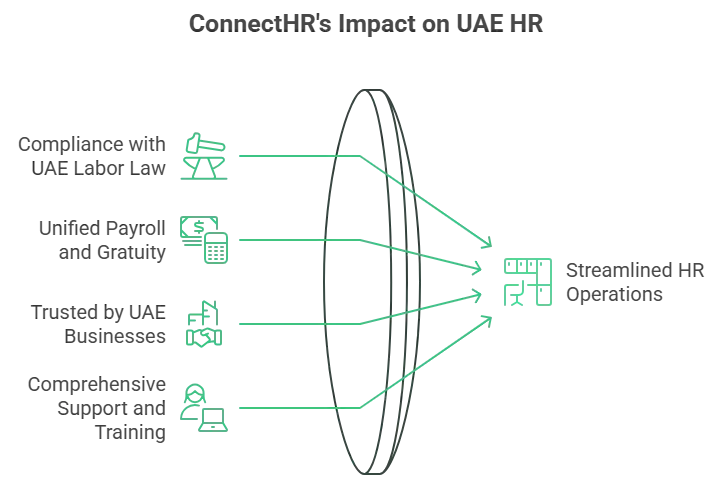

HR tech is transforming how UAE businesses handle payroll and gratuity—and ConnectHR is leading the way. Here’s why more companies are making the switch.

- ConnectHR is designed for UAE labor law. It ensures your HR process is compliant without manual effort. The platform is updated regularly with new legal requirements.

- From salaries to gratuity, ConnectHR handles everything in one platform. No more switching between tools. It helps reduce operational costs and simplifies compliance.

- Companies in Business Bay, JLT, and all over the UAE trust ConnectHR for their HR needs. Their testimonials show how the software has transformed operations and reduced compliance risks.

- ConnectHR offers hands-on support, training, and a live demo so you understand the platform fully before onboarding.

Get Ahead of 2025 Gratuity Compliance — Before It Costs You

The future of HR in the UAE is clear: proactive, digital, and fully compliant. Are you ready? With 2025’s tighter labor regulations, getting gratuity benefits right isn’t a “nice-to-have”. It’s a must. Errors in end-of-service calculations can lead to audits, fines, and serious damage to your company’s reputation.

Why risk it?

Thousands of UAE businesses are already switching to ConnectHR. It is the smart, all-in-one HR solution built for local laws, automated compliance, and stress-free gratuity tracking.

No more spreadsheets.

No legal guesswork.

Just accurate, compliant payouts — every time.

Take the smarter route. Book your free ConnectHR demo today and make gratuity compliance one less thing to worry about.