In today’s rapidly evolving business environment, managing HR and payroll functions with high accuracy and effectiveness can be a very hard and critical step for companies operating in the UAE.

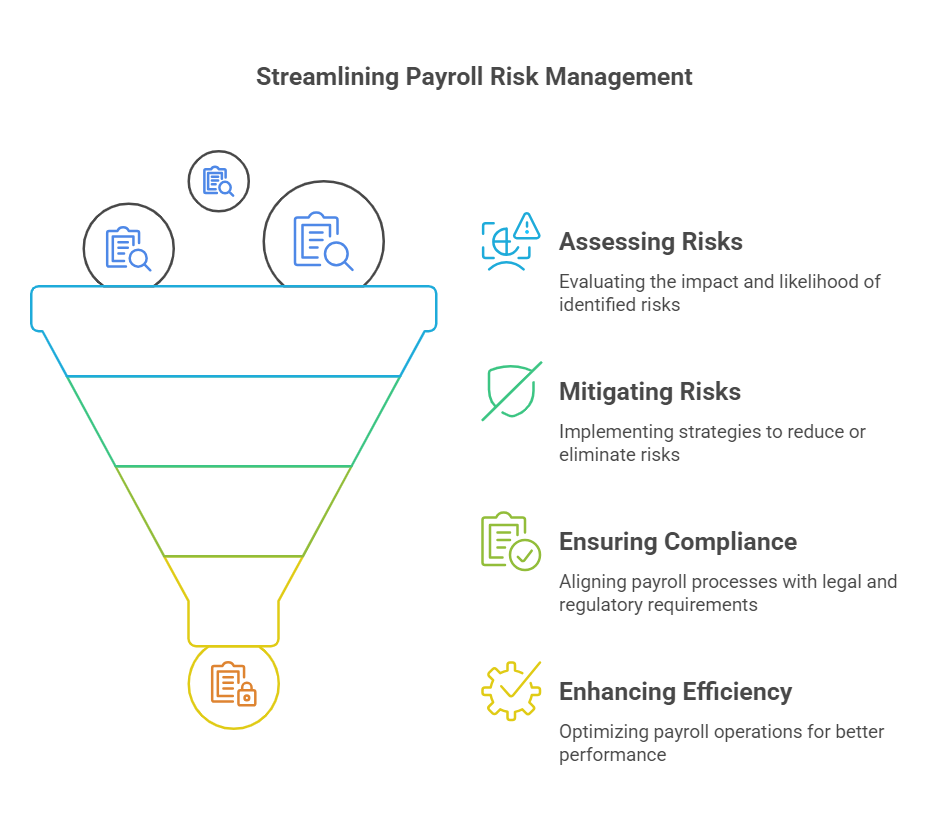

Security frauds regarding payroll have been garnered as a serious issue across the world, this is one of the many payroll risks that a company has to face. To protect your data and systems from payroll risks, more and more businesses are focusing on payroll risk management: the process of identifying, assessing, and mitigating potential risks associated with an organization’s payroll operation. The laws and regulations change regularly, increasing complexity in payroll systems, and the need to establish a system that protects sensitive information and data of the employees, many businesses are thinking of opting for HR and payroll consulting services to mitigate risks and ensure seamless operations.

In this article, we will introduce you to the steps of how HR and payroll consulting, especially HR and Payroll Solution Dubai, play an integral role in minimizing risk and maintaining accuracy in businesses.

ConnectHR a Trusted Solution Provider:

One of the leading providers of HR and payroll solutions in the UAE is ConnectHR, offering businesses reliable and customized consulting services. ConnectHR brings a wealth of expertise in both HR and payroll management, ensuring that businesses meet regulatory requirements while optimizing their internal processes. By leveraging advanced technology and compliance knowledge, ConnectHR provides comprehensive support to businesses looking to reduce risk and enhance operational efficiency.

Common Risks in HR and Payroll Management:

HR and payroll management comes with its fair share of risks. Companies that fail to address these risks may face significant financial and legal consequences. Below are the primary risks businesses encounter in HR and payroll management:

Compliance Risks: Labor laws, Visa Regulations, and Yaxation

UAE labor laws are always changing, particularly since new restrictions on working hours, employee perks, and visa requirements were introduced. Penalties, fines, or even legal action may follow noncompliance with certain restrictions. Companies need to make sure they keep abreast of any legal changes, such as the implementation of new tax laws, required perks for employees, or modifications to work visa regulations. To navigate these requirements and guarantee complete compliance, HR and payroll advisors are essential.

Data Security Risks: Protecting Private Employee Information

One of the main concerns in payroll and HR management is the protection of employee data. Payroll records include very sensitive information, including personal, salary, and banking details. Identity theft, fraud, or legal repercussions may result from improper management or illegal access to this data. Businesses need to put strict security measures in place to safeguard this sensitive data since cyberattacks are becoming a bigger concern. Payroll and HR specialists can suggest and put into place cutting-edge security measures that protect employee information.

Security involves making accurate steps that help protect sensitive data and crucial systems from unauthorized access. This includes major steps like encryption, controlling the access, and regular assessments that are open. Requiring multi-factor authentication (MFA) and adapting very strong password policies are the most important and basic security tasks that should be taken care of. Everyone can relate to them in their daily digital lives.

Accuracy Risks: Payroll Errors and Miscalculated Benefits

Payroll mistakes, no matter how little, may cause serious problems. These may contain calculations of benefits that are inaccurate, overpayments, payments not meeting the deadlines, or improper deductions. Payroll processing errors can result in unhappy workers, strained employer-employee relations, and possible legal issues.

Inaccurate tax withholding or erroneous contribution payments can also result in tax fines for enterprises. These risks can be reduced by using automated and error-resistant payroll and HR systems in Dubai.

The Role of HR and Payroll Consulting in Risk Mitigation

To detect, mitigate, and manage risks that might cause serious issues for a company’s accuracy, security, and compliance, HR and payroll specialists are essential. Consultants can assist with risk mitigation in the following ways:

Ensuring Compliance with UAE Labor Laws and Regulatory Updates

Payroll and HR specialists are knowledgeable about the most recent labor rules and regulations in the United Arab Emirates. They guarantee that companies are constantly operating by the most recent laws. This covers everything from working hours, employee rights, and end-of-service rewards to wage protection systems (WPS). To reduce compliance concerns, consultants make sure businesses have accurate records and are aware of any changes to the law.

Enhancing Data Security Through Advanced Payroll Systems

One of the most sensitive assets your business handles is payroll data, which includes a multitude of private information ranging from bank routing numbers to individual employee details. Regrettably, hackers frequently target this important data. Payroll theft affects 27% of firms, according to a 2024 ACFE survey. Surprisingly, these breaches frequently go unnoticed for an average of 36 months.

Such occurrences can have disastrous financial effects, with losses sometimes amounting to tens of thousands of dollars each episode. In addition to the financial consequences, businesses run the danger of legal action, criminal prosecution, and permanent harm to their reputation. Since a single breach might have disastrous consequences for smaller teams or businesses with thin finances, payroll data protection is an absolute must.

By implementing state-of-the-art payroll systems, HR and payroll consulting enhance data security and safeguard sensitive employee information. With cloud-based solutions and encrypted payroll systems, consultants ensure that businesses store and transmit data securely. This reduces the risk of data breaches and ensures that only authorized personnel have access to payroll information.

Streamlining Payroll Processes to Reduce Human Error

Regrettably, manual data entry exacerbates the problem due to its susceptibility to human error. Every manual action introduces the potential for mistakes, including mistyped figures and misread details. These errors are not mere oversights; they represent critical issues that can compromise the financial integrity of the payroll system, diminish employee trust, and expose the company to regulatory penalties. This underscores the imperative for precision in payroll management.

How ConnectHR Helps Businesses Ensure Accuracy?

ConnectHR is a trusted partner for businesses looking to streamline HR and payroll functions. Here’s how ConnectHR ensures accuracy and mitigates risk:

Real-Time updates on Compliance and Regulatory Changes:

ConnectHR gives companies up-to-date information on regulatory changes that affect HR and payroll administration. ConnectHR ensures that companies keep ahead of any changes, lowering the risk of non-compliance, from new tax rules to changes in employee benefits legislation.

Automated Payroll Calculations and Error Detection

With automated payroll systems, ConnectHR ensures that payroll calculations are accurate every time. These systems detect errors before they occur, such as incorrect tax withholding or benefit miscalculations. This minimizes the risk of payroll errors and ensures that employees are paid correctly.

Secure, Cloud-Based Data Storage to Protect Employee Information

ConnectHR makes use of extremely secure cloud-based payroll systems to safeguard confidential employee data from unwanted access. Businesses of any size or expansion can safely handle employee data thanks to these solutions’ easy scalability.

Benefits of Partnering with ConnectHR for Risk Mitigation:

Partnering with ConnectHR brings several benefits to businesses, helping them mitigate risks and ensure payroll accuracy.

Cost Savings Through Error Reduction and Process Efficiency

Cost reduction is the business practice of reducing expenditures to increase profits. The complicated part is identifying which expenses get cut, which aren’t providing sufficient value for your budget, and what process optimizations you can make to improve spending efficiency.

A business might reduce pay, discontinue unprofitable new products, close facilities, reduce office space due to remote working, or cut spending on outsourcing for professional services like consulting. But more involved changes include streamlining your product lineup to make better use of raw material costs and labor costs, shifting operations or personnel among departments to lower costs, and striving for high-quality products with less rework due to faulty parts. It’s a far more dynamic procedure than it initially sounds and is rarely as simple as merely cutting expenses.

Improved Employee Satisfaction with Accurate and Timely Payroll

Employees rely on accurate and timely payroll for their financial security. Partnering with HR payroll consultants like ConnectHR ensures that employees are paid correctly and on time, boosting morale and reducing employee turnover.

Customized Solutions Tailored to UAE-Specific Business Needs

ConnectHR offers customized HR and payroll solutions in Dubai and across the UAE. These solutions are tailored to meet the unique needs of each business, ensuring compliance with local labor laws and optimizing payroll processes according to the size, structure, and industry of the organization.

Case Study: Success Story of a UAE-Based Business with ConnectHR

Connect HR, a leading HR solutions provider in Dubai, has successfully assisted numerous companies in mitigating payroll risks and ensuring accuracy. Here are a few examples:

Connect Resources:

Connect Resources, a prominent HR company in Dubai, has achieved a 99% on-time payroll accuracy rate by utilizing Connect HR’s comprehensive services. Their commitment to quality and innovation has streamlined payroll processes, ensuring compliance with local regulations and enhancing overall efficiency.

Binance:

Binance, a global leader in cryptocurrency and blockchain technology, has leveraged Connect HR’s solutions to streamline employee management and optimize payroll operations. By integrating advanced HR tools, Binance has achieved enhanced efficiency in managing its growing workforce while maintaining compliance with regional regulations, enabling it to sustain its leadership position in the tech industry.

Microsoft:

Microsoft, a multinational technology giant, has benefited significantly from Connect HR’s customized HR and payroll solutions. With a focus on efficiency and compliance, Connect HR has supported Microsoft in handling complex payroll processes across its diverse workforce, ensuring seamless operations and adherence to legal requirements. This aligns with Microsoft’s commitment to excellence in all aspects of its business.

These examples demonstrate how Connect HR’s innovative solutions have enabled UAE-based businesses to mitigate payroll risks and ensure accuracy, contributing to their overall success.

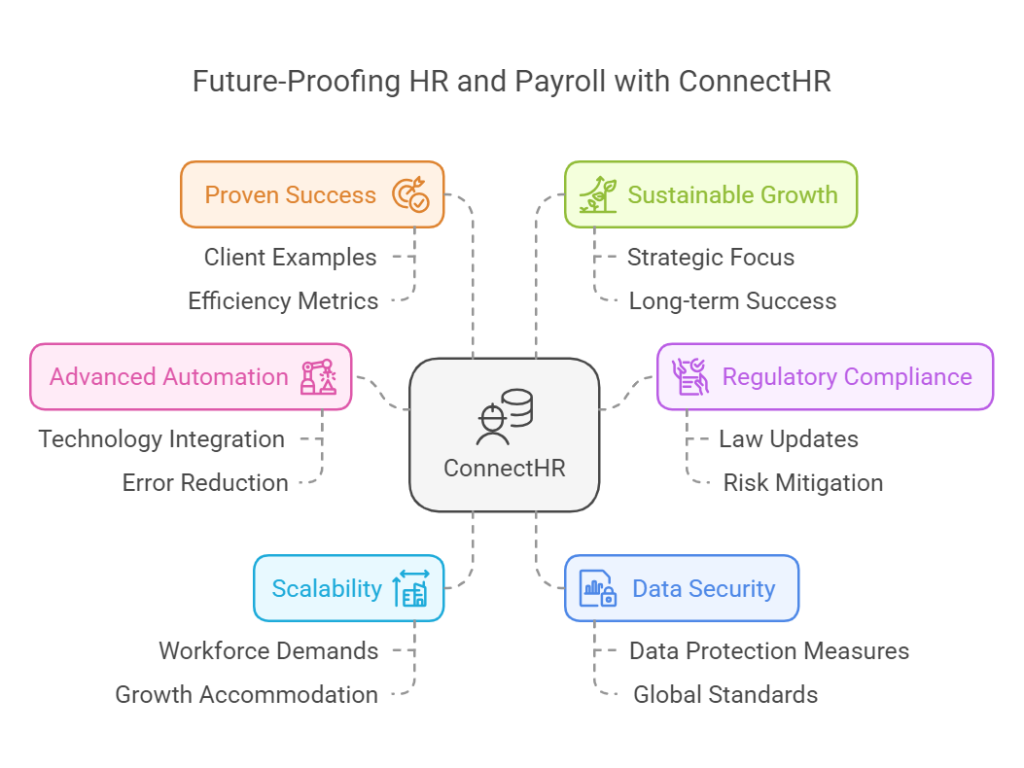

Future-Proofing HR and Payroll with ConnectHR

As business environments evolve and regulations change, it’s essential to stay ahead of trends in HR and payroll management. Here’s how ConnectHR ensures that businesses are future-proofed:

- Advanced Automation: ConnectHR leverages cutting-edge technology to automate payroll and HR processes, reducing manual errors and saving time.

- Regulatory Compliance: Ensures businesses stay updated with evolving UAE labor laws, mitigating legal risks and penalties.

- Scalability: Flexible solutions designed to grow with businesses, accommodating increasing workforce demands seamlessly.

- Data Security: Implements robust data protection measures to safeguard sensitive employee information, aligning with global standards.

- Proven Success: Businesses like Connect Resources, Bayzat, and Gini Talent have demonstrated how ConnectHR’s services drive efficiency and reliability.

- Sustainable Growth: By future-proofing HR operations, companies can focus on strategic goals, fostering long-term success.

Conclusion: Why ConnectHR is the Right Partner for UAE Businesses

In today’s complex business environment, HR and payroll consulting is essential for businesses that want to minimize risk and ensure accuracy in their payroll processes. ConnectHR’s expertise in compliance, data security, and payroll accuracy makes it the ideal partner for businesses operating in the UAE. With ConnectHR, companies can rest assured that their HR and payroll functions are optimized, secure, and fully compliant with local regulations.