Employees of any business must feel confident to fulfill their tasks and eager to learn more. This is pushed forward by accurate and timely payroll management. Running a business in the UAE comes with great responsibility of effective Payroll management. Not only does it work as the backbone of major tasks of a business but it also boosts employee satisfaction and compliance. In this guide, we’ll unravel the secrets to managing payroll for small business in the UAE, helping you build trust, avoid errors, and set your business up for long-term success.

Why Payroll Management is Crucial for Small Businesses?

The payroll management of small businesses is as important as for large companies. It goes by the salary process. Payroll encompasses compliance with labor laws as well as employee satisfaction. This ultimately leads to employee retention and builds up their trust. Good payroll management of small businesses operating in the UAE directly impacts business reputation. Along with ensuring timely payment, the deductions are taken care of accurately. This paves the way for sustainable business.

Common Payroll Challenges Small Businesses Face:

Small businesses often face challenges like limited resources, lack of expertise, and time constraints when managing payroll.

Common issues include:

- Compliance Errors: Misunderstanding UAE labor laws or Wage Protection System (WPS) requirements.

- Payroll Errors: Miscalculations in salaries, deductions, or benefits.

- Cash Flow Issues: Inconsistent revenue streams leading to late salary payments.

How ConnectHR Simplifies Managing Payroll for Small Business?

ConnectHR is a robust solution for small businesses in the UAE. It automates payroll processes and integrates with accounting systems. With features tailored to UAE labor regulations, ConnectHR helps businesses save time and reduce errors, enabling them to focus on growth.

Understanding Payroll: The Basics

Grasp the concept of payroll components and processes. This will help you move forward without confusion. Understanding payroll basics lays the groundwork for accuracy and precision.

What is Payroll?

The process of compensating employees with their entitled salaries refers to payroll. This requires comprehensive expertise in major tasks. Calculating salaries and dispatching them timely while deducting taxes and benefits, a Payroll is not just a financial process but a critical HR function that impacts employee morale and legal compliance.

Key Components of Payroll Processing:

- Employee Information including names, job titles, and employment types.

- Salary Details which covers Gross salary, bonuses, and deductions.

- Deductions in salary like Social Security, gratuity, and any other statutory contributions.

- Payment Methods can be Bank transfers, cheques, or WPS-compliant systems.

Employee Classification: Full-Time, Part-Time, and Contractors

Understanding employee classification is vital for payroll accuracy:

- Full-Time Employees: Entitled to full benefits like health insurance and gratuity.

- Part-Time Employees: Paid based on hours worked, with fewer benefits.

- Contractors: Independent workers who manage their taxes and benefits.

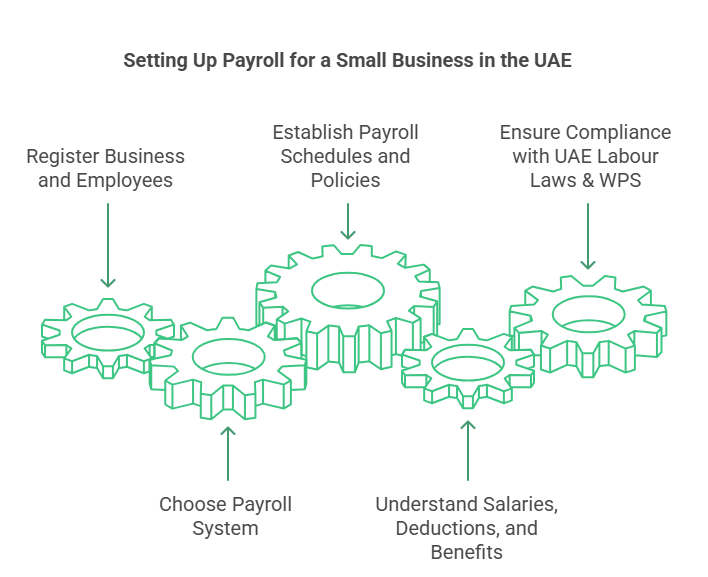

Setting Up Payroll for a Small Business:

If you are running a small business in the UAE, you must understand the value of careful planning. While staying compliant with UAE labor laws and following this step-by-step guide, you will be all set to make your payroll system rolling.

Step 1: Registering Your Business and Employees

First thing first, register your business with the Ministry of Human Resources and Emiratisation MOHRE. Each employee must have a labor contract and Emirates ID.

Step 2: Choosing a Payroll System (Manual vs. Automated)

- Manual Systems: Suitable for very small teams but prone to errors.

- Automated Systems: Software solutions like ConnectHR streamline calculations, compliance, and reporting.

Step 3: Establishing Payroll Schedules and Policies

Define payroll schedules (monthly or bi-weekly) and policies for overtime, leaves, and bonuses to maintain consistency and transparency.

Step 4: Understanding Salaries, Deductions, and Benefits

Be transparent with the employees from the start. This means communicating about basic salary, allowances, and statutory deductions. As per the government standards benefits such as housing allowances and gratuity.

Step 5: Ensuring Compliance with UAE Labour Laws & WPS

The UAE’s Wage Protection System WPS mandates electronic salary transfers through approved channels. Non-compliance can lead to penalties, making it crucial for small businesses to adhere to this requirement.

Payroll Compliance for Small Businesses in the UAE:

The major component of following the legal regulations is using Wage Protection System WPS. It ultimately helps maintain employees, it is crucial for avoiding penalties and maintaining employee trust.

Wage Protection System (WPS) Compliance:

The WPS ensures that employees receive their salaries on time and through approved channels.

To comply:

- Register with a WPS-approved bank.

- Submit employee salary files in the required format.

- Ensure timely payments to avoid fines.

Managing End-of-Service Benefits and Gratuity Payments:

End-of-service benefits are mandatory for employees who complete at least one year of service. Calculate gratuity accurately based on the employee’s last drawn salary and years of service.

Tax and Legal Considerations for Small Business Payroll:

While the UAE does not impose income tax, businesses must consider VAT for certain benefits and ensure compliance with MOHRE regulations.

Avoiding Common Payroll Compliance Mistakes:

- Failing to update employee records.

- Misclassifying employees.

- Missing deadlines for WPS submissions.

Choosing the Right Payroll Solution for Your Small Business:

The payroll solution manages everything effectively. Along with saving time, it reduces errors. Therefore, it is important to hire the right system that fulfills the specific needs of small businesses.

Features to Look for in a Payroll System:

- Ease of Use: User-friendly interfaces.

- Compliance Tools: Built-in UAE labor law compliance.

- Integration: Compatibility with HR and accounting systems.

- Customization: Flexible for unique business needs.

Why Cloud-Based Payroll is Ideal for Small Businesses?

Cloud-based payroll systems offer accessibility, data security, and automatic updates. They are cost-effective and eliminate the need for extensive IT infrastructure.

How ConnectHR Helps Small Businesses Automate Payroll Effortlessly?

ConnectHR simplifies payroll with automated calculations, compliance checks, and real-time reporting. Its WPS-compliant system ensures secure salary transfers, making it an ideal choice for small businesses.

Common Payroll Challenges & How to Overcome Them

Small businesses encounter many setbacks that hinder their day-to-day functions. There can be errors with the cash flow issues or compliance. Acknowledging and addressing these pitfalls timely will make the path clear.

Late Salary Payments and Cash Flow Issues:

Late payments can harm employee morale and attract penalties.

Overcome this by:

- Using automated reminders for salary schedules.

- Maintaining a cash reserve for payroll.

Payroll Errors and Miscalculations:

Errors can lead to legal complications. Use payroll software to automate calculations and reduce manual entry mistakes.

Handling Payroll for Remote and Freelance Employees:

For remote workers, ensure compliance with cross-border tax laws and accurate invoicing for contractors.

Ensuring Payroll Security and Data Protection:

Secure employee data by using encrypted systems and limiting access to sensitive information. Cloud-based systems like ConnectHR provide advanced security features.

| Common Payroll Issues | Impact on Businesses | Solutions |

| Late Payments | Employee dissatisfaction | Automate salary schedules |

| Compliance Errors | Legal penalties | Use compliance-focused software |

| Manual Calculation Mistakes | Financial losses | Implement automated payroll systems |

| Data Breaches | Loss of trust and legal issues | Invest in secure cloud-based systems |

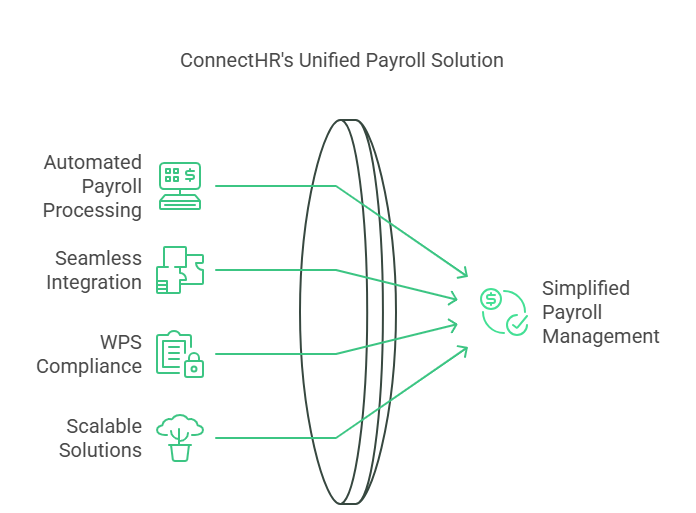

How ConnectHR Simplifies Managing Payroll for Small Business?

ConnectHR offers an all-in-one solution for managing payroll for small business efficiently, with automation and compliance tools tailored to UAE regulations.

- Fully Automated Payroll Processing: ConnectHR automates the entire payroll cycle, from salary calculations to WPS submissions, reducing manual effort and errors.

- Seamless Integration with HR and Accounting Systems: ConnectHR integrates with existing HR and accounting tools, creating a unified platform for managing employee data and financial records.

- WPS Compliance and Secure Transactions: Experience the secure and transparent transactions with ConnectHR. Businesses in the UAE can make their salary processing WPS-compliant salary to enable smooth transfers. This ultimately protects them from fines and legal complications.

- Scalable Payroll Solutions for Growing Businesses: As your business grows, ConnectHR’s scalable features adapt to your needs, making it a long-term payroll solution.

The Future of Managing Payroll for Small Business

With the growing tech era, payroll management is also taking turns of advancement. Now, it leverages automation and AI-driven solutions for better functionality. Following these trends can simplify processes and improve efficiency.

The future of payroll lies in automation and artificial intelligence. AI-powered tools can predict cash flow needs, automate compliance updates, and enhance data accuracy.

Outsourcing payroll allows access to matchless expertise. An efficient tool like ConnectHR boosts the progress of small businesses significantly. Handling their payroll, they provide ample time to focus on strategic growth.

How to Get Started with ConnectHR for Hassle-Free Payroll

Getting started with ConnectHR is simple. Schedule a demo, customize your payroll solution, and experience seamless payroll management tailored to your business needs.

Understand the essentials of managing payroll for small business and leveraging tools like ConnectHR. Businesses in the UAE can streamline operations, ensure compliance, and drive growth in a competitive market with this tech partner by side.