Establishing and operating your business in the UAE brings a lot of profit to the table. Along with the progress, running a business comes with a lot of responsibilities. The foremost and unavoidable among them is Payroll Obligations. The company owners are entitled to follow the legal requirements and regulations said by the country’s government. This practice keeps them on the right track, away from the penalties. Not only will the employers be able to maintain a positive work environment but also escape potential risks.

Consider this article your helping guide to understand the dynamics of payroll obligations in the UAE. Covering the updated 2025 aspects, discover essential payroll laws and processing steps. Also, address common challenges while being aware of the outsourcing benefits, and future trends.

What Are Payroll Obligations?

Payroll obligations are the legal requirements that every business has to fulfill. It’s the financial responsibility a business possesses when compensating employees. Salary payments, deductions, tax compliance, and employee benefits are the major factors to take care of. Following payroll obligations helps businesses avoid disputes, build trust with employees, and remain legally compliant.

UAE Payroll Laws and Regulations

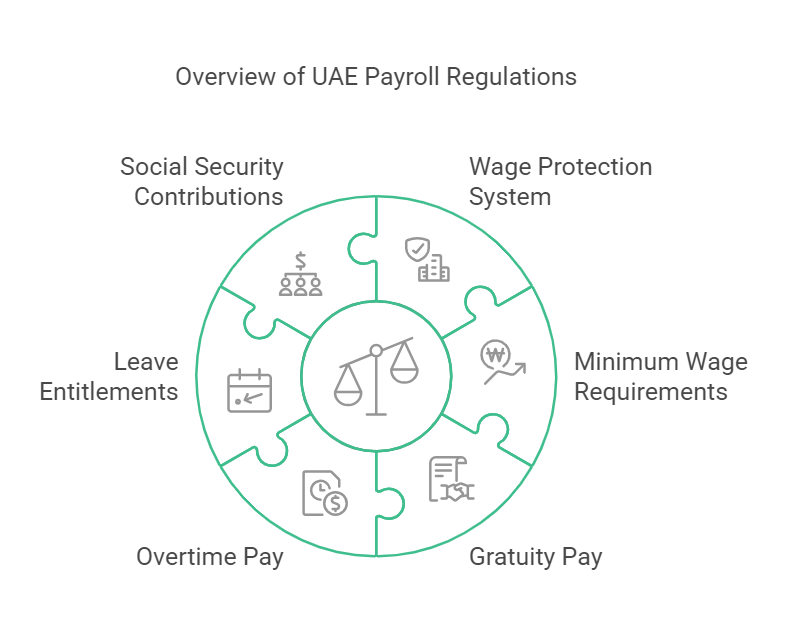

The UAE has strict labor laws that govern payroll processes. Businesses must follow these key legal regulations:

- Wage Protection System WPS – The employee’s salary must be processed through the WPS, ensuring transparency in transactions.

- Minimum Wage Requirements – although there is no standard minimum wage for all employees. However, the wage is standardized in certain professions.

- End-of-Service Benefits Gratuity Pay – Employees must receive gratuity payments once their contract ends based on their last drawn salary. It is applicable for employees who complete at least one year of service.

- Overtime Pay: Employees working beyond standard hours receive overtime pay.

- Leave Entitlements: Employees are entitled to annual leave, sick leave, and maternity/paternity leave.

- Social Security and Pension Contributions: UAE nationals must be registered with the General Pension and Social Security Authority (GPSSA), and employers contribute a percentage of their salary.

These laws protect both employees and businesses, creating a fair and structured payroll system.

Save time and money with our innovative HRMS software.

Key Components of Payroll Processing

Payroll processing involves multiple steps to comply with UAE laws and meet employee expectations. Here are the key components:

- Employee Classification: Businesses must categorize workers correctly as full-time, part-time, or contract-based.

- Salary Structuring: A salary package typically includes a basic salary, housing allowance, transportation allowance, and other benefits.

- Deductions and Contributions: Businesses deduct social security contributions, insurance, and other mandatory payments.

- Payroll Software or Outsourcing: Many companies use payroll software or external services to streamline operations.

- Payroll Compliance Audits: Regular checks help businesses stay within legal requirements.

Table: Common Payroll Obligations and Their Requirements

| Payroll Obligation | Requirement |

| Wage Protection System (WPS) | Required for private sector employers to process salaries through WPS. |

| End-of-Service Gratuity | Paid to employees with at least one year of service, based on salary and tenure. |

| Overtime Pay | Additional compensation for extra working hours. |

| Annual Leave | Minimum 30 days of paid leave after one year of service. |

| Pension Contributions | Mandatory for UAE nationals under GPSSA regulations. |

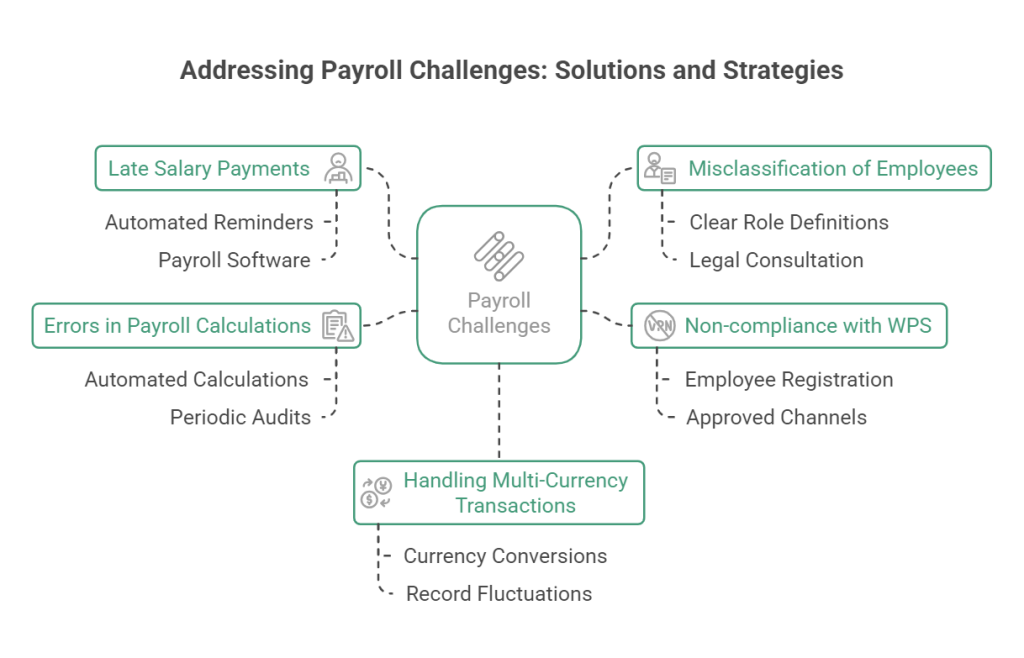

Common Payroll Challenges and How to Overcome Them

Payroll management is accompanied by many challenges. These setbacks affect compliance and efficiency poorly if not addressed on time. Recognizing these challenges early leads to easily finding effective solutions while avoiding financial or legal risks.

1. Late Salary Payments

Delayed salary payments harm employee morale and may lead to legal consequences. To prevent delays:

- Set automated reminders for salary processing dates.

- Use payroll management software for timely transactions.

2. Misclassification of Employees

Confusion between full-time employees, contractors, and freelancers can cause legal complications. To avoid this:

- Define employee roles clearly in contracts.

- Consult legal advisors when hiring staff.

3. Non-Compliance with WPS

Ignoring WPS requirements can lead to fines and business restrictions. To follow the rules:

- Register all employees with the WPS.

- Process salaries only through approved banking channels.

4. Errors in Payroll Calculations

Payroll miscalculations may lead to disputes and fines. To reduce errors:

- Implement payroll software with automated calculations.

- Conduct periodic payroll audits.

5. Handling Multi-Currency Transactions

The businesses that hire expatriates have to give the salaries in their currency. It becomes complicated to manage salary payments in different currencies. To manage this:

- Use banking services that offer seamless currency conversions.

- Keep records of currency fluctuations to avoid discrepancies.

Importance of Outsourcing Payroll Services

Importance of Outsourcing Payroll Services

Managing payroll often becomes hefty for businesses in the UAE. This is where payroll outsourcing stands out as the ideal solution. Outsourcing comes with plenty of advantages:

- Legal Compliance: Experts stay updated with labor laws and prevent costly mistakes.

- Cost and Time Savings: Businesses save money and resources by reducing manual work.

- Precise Calculations: using advanced software, payroll experts introduce an error-free approach.

- Focus on Core Business Operations: Employers can dedicate more time to business growth rather than administrative tasks.

- Data Security: Professional firms use encrypted payroll systems to protect confidential data.

Businesses that outsource payroll often experience smoother operations, fewer compliance issues, and reduced administrative burden.

Stay ahead of the game with our innovative HRMS software!

Future of Payroll Management in the UAE:

Technology and legal advancements are rapidly shaping payroll management. Keep up with the changes and follow some future possible key trends:

- Automation of Payroll Processes: The use of AI-driven payroll software reduces human errors and saves processing time.

- Cloud-Based Payroll Solutions: Businesses can access payroll data remotely, ensuring flexibility and efficiency.

- Blockchain for Payroll Security: Blockchain technology improves transparency and security in transactions.

- Integration with HR Systems: Combining payroll with HR software simplifies employee management.

- Adoption of Digital Payments: More businesses are shifting towards digital salary transfers to enhance efficiency.

With all these innovations, the payroll landscape becomes more efficient. This helps businesses to stay compliant with reduced administrative workload.

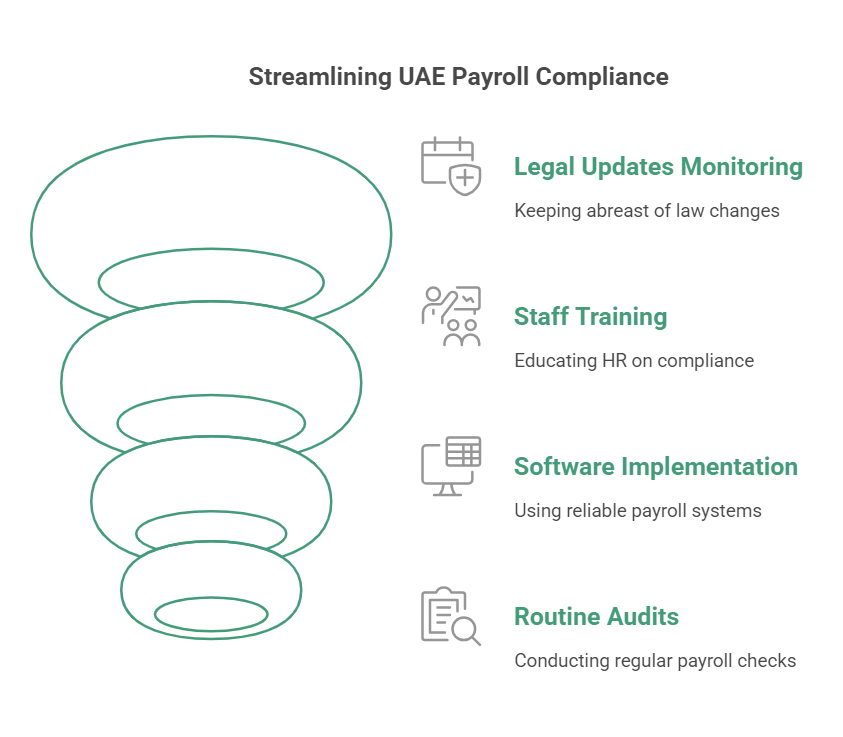

Tips for Staying Compliant with UAE Payroll Regulations

Take the right measures to follow payroll regulations. These suggestions will make your process trouble-free and faster:

- Keep updated records of employee contracts, salaries, and benefits.

- Regularly check for changes in UAE labor laws to avoid penalties.

- Train HR and payroll staff on compliance requirements.

- Use reliable payroll software to manage employee payments.

- Conduct routine payroll audits to identify and fix errors.

Staying on top of these practices will help businesses avoid legal trouble and maintain smooth payroll operations.

Conclusion: Simplifying Payroll for Long-Term Success

Conclusion: Simplifying Payroll for Long-Term Success

Payroll obligations are the responsibility of every business owner in the UAE. It is followed by understanding legal requirements and structuring salaries correctly. Seamless and expert handling of deductions accurately can prevent fines and potential disputes or disagreements. Many companies work smartly by using the convenience of payroll outsourcing. The advanced payroll software makes the payroll process convenient and easier to manage.

Moreover, the system must understand the evolving business landscape and trends. Following the latest update in regulations, businesses stay ahead of the curve in a competitive edge. Whether handling payroll in-house or outsourcing, having a well-organized payroll system contributes to business stability and employee satisfaction.