In the fast-paced world of business, managing payroll accurately and efficiently can be a time-consuming challenge. This is especially true for companies in the UAE, where compliance with labor laws, the Wage Protection System (WPS), and end-of-service benefits add layers of complexity. To address these challenges, many businesses are choosing to outsource payroll. The growing need for payroll outsourcing stems from the desire to focus on core business activities while ensuring compliance and cost savings. Additionally, advancements in technology and cloud-based solutions have made outsourcing payroll more accessible and secure than ever.

This guide explores how to outsource payroll effectively, covering every step to help UAE businesses streamline their payroll processes and achieve greater operational efficiency.

Key Benefits: Accuracy, Compliance, and Cost Savings

Outsourcing payroll comes with numerous advantages:

- Accuracy: Professional payroll providers minimize errors, ensuring employees are paid correctly and on time. They leverage advanced software to handle calculations, tax deductions, and other critical payroll functions.

- Compliance: They stay updated on UAE labor laws, safeguarding businesses from costly penalties. As laws continue to evolve in 2025, payroll providers ensure your business remains compliant with the latest regulations.

- Cost Savings: Outsourcing eliminates the need for in-house payroll software and staff, reducing overhead expenses. Businesses can redirect these savings toward growth initiatives.

- Time Efficiency: Payroll processing can be a tedious task, especially for growing companies. By outsourcing, businesses can save valuable time that can be invested in strategic decision-making.

- Access to Expertise: Payroll providers employ specialists who understand the complexities of payroll, tax, and compliance, ensuring a smoother process.

Why UAE Businesses Are Turning to Payroll Outsourcing

Businesses in the UAE face unique challenges such as adhering to WPS regulations, managing gratuity calculations, and staying compliant with labor laws. With the UAE’s growing emphasis on transparency and digital transformation, outsourcing payroll has become a strategic choice. By offloading these responsibilities to experts, businesses can concentrate on their core objectives, improve operational efficiency, and stay ahead of competitors.

Understanding Payroll Outsourcing: What It Means

Payroll outsourcing involves hiring an external service provider to manage payroll-related tasks such as salary disbursement, tax filings, compliance reporting, and employee benefits management. These providers leverage advanced technology to ensure seamless payroll operations, offering businesses peace of mind.

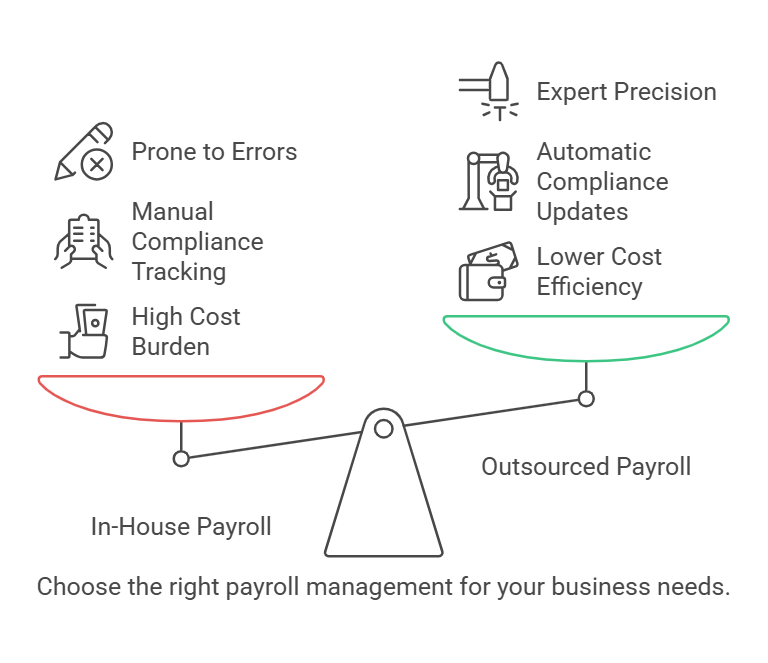

How It Differs from In-House Payroll Management

In-house payroll management requires dedicated staff, software, and constant updates on regulatory changes. It often involves manual processes, which can lead to errors. In contrast, payroll outsourcing transfers these responsibilities to experts, ensuring more accuracy and fewer disruptions. Moreover, outsourced payroll services typically offer advanced automation and cloud-based platforms, which can integrate seamlessly with a company’s existing systems.

Common Myths About Payroll Outsourcing

- Myth 1: Outsourcing is only for large businesses.

- Truth: Small and medium-sized businesses (SMBs) benefit significantly from outsourcing due to reduced costs and access to expertise.

- Myth 2: Data security is at risk.

- Truth: Reputable providers prioritize robust security measures, including encryption and multi-factor authentication, protecting sensitive information from breaches.

- Myth 3: It’s expensive.

- Truth: The cost of outsourcing is often lower than maintaining an in-house payroll team, especially when considering the expenses of software, training, and compliance management.

- Myth 4: It reduces control over payroll.

- Truth: Businesses retain control over critical decisions while delegating the operational aspects to specialists.

Step-by-Step Guide to Outsourcing Payroll

Step 1: Assess Your Business Payroll Needs

Before outsourcing, evaluate your current payroll processes:

- Identifying Payroll Pain Points: Are errors common? Is compliance a challenge? Understanding where your current system falls short will help you identify what you need from a payroll provider.

- Evaluating Compliance Requirements: Understand UAE’s labor laws, WPS obligations, and tax regulations. This ensures your provider can handle your specific compliance needs.

- Determining Budget and Resources: Calculate how much you’re willing to spend on outsourcing. Consider the long-term cost savings when evaluating the upfront investment.

Step 2: Research and Choose the Right Payroll Provider

When selecting a provider, consider:

- Compliance: Ensure they’re familiar with UAE’s payroll regulations, including WPS, gratuity calculations, and tax laws.

- Security: Look for providers with secure cloud-based solutions and advanced data protection measures.

- Support and Technology: Check if they offer 24/7 support, mobile access, and user-friendly platforms that can integrate with your existing systems.

- Reputation: Research reviews, client testimonials, and case studies to assess the provider’s reliability.

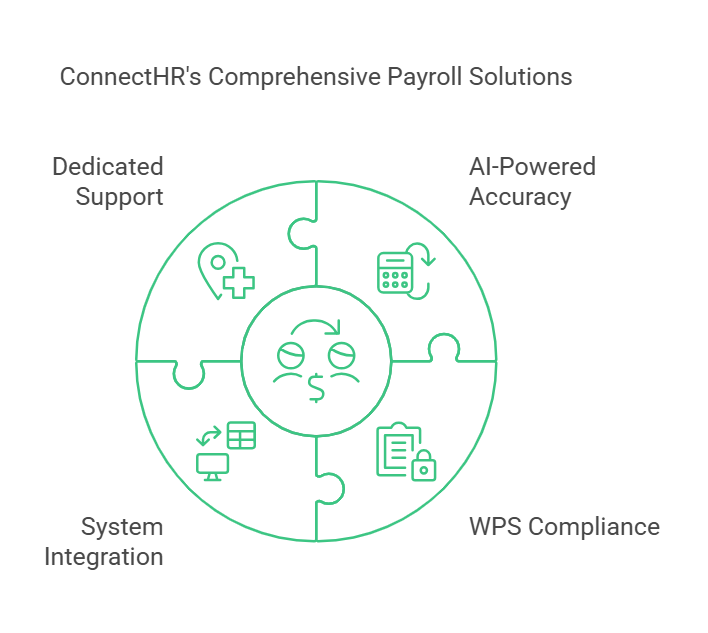

Why UAE Businesses Trust ConnectHR for Payroll Outsourcing?

ConnectHR is a trusted partner known for its compliance expertise, secure solutions, and tailored payroll services that address UAE-specific needs. Their AI-powered accuracy and seamless integration capabilities make them a preferred choice for businesses of all sizes.

Step 3: Ensure Compliance with UAE Payroll Regulations

Compliance is crucial when outsourcing payroll:

- Understanding WPS Requirements: Ensure salary disbursements align with WPS standards to avoid fines or legal issues.

- Handling End-of-Service Benefits: Accurately calculate gratuity payments based on employee tenure and salary.

- Tax and Legal Compliance: Adhere to VAT and other tax laws applicable in the UAE. A reliable provider will stay updated on regulatory changes to keep your business compliant.

Step 4: Integration with Your HR and Finance Systems

Seamless integration is key:

- Ensuring Data Flow: Link payroll systems with your HRMS and accounting software to streamline processes and reduce duplication of work.

- Automating Processes: Use automation to reduce manual errors, enhance efficiency, and ensure timely salary disbursement.

Step 5: Data Security and Confidentiality Measures

Protect sensitive employee information:

- Secure Cloud-Based Solutions: Choose providers with encrypted, cloud-based systems that protect data from breaches.

- Access Control: Limit access to sensitive payroll data through multi-layered authentication protocols.

- Data Backup: Ensure the provider has a robust backup plan in case of system failures.

Step 6: Transitioning to the Outsourced Payroll System

A smooth transition is essential:

- Onboarding Process: Collaborate with the provider for a seamless setup, including data migration and system configuration.

- Employee Training and Communication: Inform employees about the new payroll process, addressing concerns and ensuring transparency.

Step 7: Monitoring and Optimizing Payroll Performance

Ensure long-term success:

- Setting KPIs: Measure payroll efficiency using key performance indicators such as accuracy, timeliness, and employee satisfaction.

- Regular Audits: Conduct compliance checks and system audits to maintain accuracy and address potential issues.

- Feedback Loop: Collect feedback from employees and stakeholders to improve the process continually.

Table: Comparing In-House vs. Outsourced Payroll Management

| Feature | In-House Payroll | Outsourced Payroll |

| Cost | High (software, staff, training) | Lower (fixed provider fees) |

| Compliance Updates | Manual tracking | Automatic updates by provider |

| Accuracy | Prone to human errors | Expert-driven precision |

| Security | Internal system | Encrypted, cloud-based systems |

| Scalability | Limited | Flexible, grows with your needs |

Common Challenges in Payroll Outsourcing & How to Overcome Them

Managing Payroll Across Multiple Locations

Solution: Partner with a provider experienced in handling payroll for multi-branch operations. They can ensure compliance with regional laws and manage localized payroll requirements effectively.

Ensuring Timely Salary Disbursement

Solution: Choose a provider with a proven track record of meeting deadlines. Ensure their system includes automated reminders and approvals to avoid delays.

Handling Last-Minute Payroll Adjustments

Solution: Opt for providers with flexible systems that can accommodate sudden changes, such as bonus payments or overtime adjustments, without disrupting the payroll cycle.

Why ConnectHR is the Best Payroll Outsourcing Partner in the UAE

- Automated Payroll Processing with AI-Powered Accuracy: ConnectHR uses advanced AI tools to ensure error-free payroll calculations and timely disbursements, reducing the risk of inaccuracies.

- Full WPS Compliance and Secure Transactions: They guarantee compliance with WPS regulations, safeguarding your business from fines and ensuring employees receive timely payments.

- Seamless Integration with HR & Accounting Systems: ConnectHR’s solutions integrate effortlessly with popular HR and accounting software, enabling seamless operations and reducing administrative burdens.

- Dedicated Support for UAE-Specific Payroll Needs: Their team offers round-the-clock assistance, addressing the unique challenges faced by UAE businesses, including multi-lingual support and region-specific expertise.

Conclusion: Take the Next Step Towards Hassle-Free Payroll

As businesses in the UAE grow, the complexities of payroll management will only increase. By learning how to outsource payroll effectively, you can focus on scaling your operations while ensuring accuracy, compliance, and efficiency.

ConnectHR stands out as a trusted partner, offering tailored payroll solutions designed for UAE businesses. With our expertise in WPS compliance, AI-driven accuracy, and dedicated support, you can transform your payroll process into a hassle-free, optimized system.

Get Started with ConnectHR’s Tailored Payroll Solution Today!